One-third of SA’s credit holders are battling to repay debt

Although at least 10-million South Africans are at least three months behind on their repayments, the appetite for credit remains high.

Photo: Copilot

A third of the people in South Africa with credit are struggling to repay their debts. That’s 10-million people who are three months or more behind in debt repayments, or who are facing legal action and adverse listings, according to Credit Bureau Monitor data for September 2023. That’s 10-million out of the 27-million South Africans with credit.

Part of the increase is certainly that many more people in South Africa have access to credit today than they did previously. In 2007, for example, 16.8-million people had credit and 6-million were behind in repayments. That’s nearly 36%, marginally lower than today’s ratio of 37%.

All told, South Africans are R2.3-trillion in debt according to the National Credit Regulator’s consumer credit market report. This includes home and car loans as well as credit and store cards.

South Africans’ debt comprises:

- Mortgages (52%)

- Secured credit, which includes pension-backed loans, furniture and motor accounts (22%)

- Credit facilities, which include bank overdrafts, credit, garage and retail cards (14%)

- Other debt, such as unsecured and short-term loans (12%)

Despite people struggling to pay their debts, the appetite for debt has not decreased. According to data from the National Credit Regulator, there were 15.5-million applications for credit between July and September last year. Only 31% of those applications were approved, a dramatic drop from 2007, when about 60% of loans were approved.

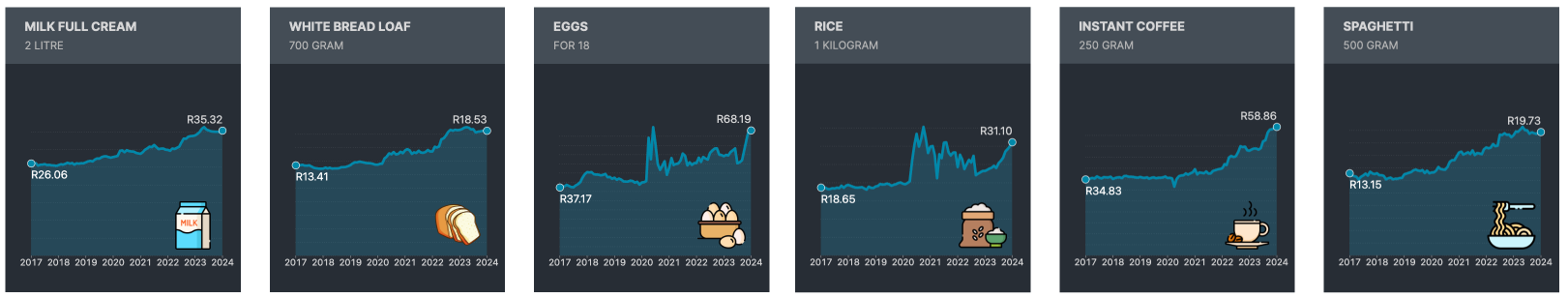

Lending institutions generally have a low tolerance for risk, explains Ans Gerber, the head of data insights at Experian, a credit bureau. They also take into account the ability of consumers to pay back their loans, which is currently constrained by high interest rates and the high cost of living.

The number of first-time home loan defaulters has also steadily increased during 2023. At its peak, it was almost as high as the Covid years.